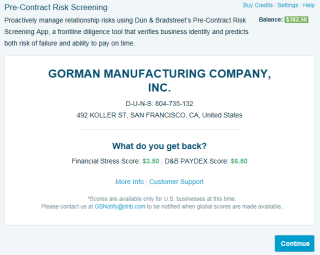

Pre-Contract Risk Screening

Welcome! Proactively manage relationship risks using Dun & Bradstreet’s Pre-Contract Risk Screening App, a front-line diligence tool that verifies business identity, predicts risk of failure, and assesses the ability of your opportunity or account to pay its bills on time.

Why Dun & Bradstreet?

Dun & Bradstreet (NYSE: DNB) grows the most valuable relationships in business. By uncovering truth and meaning from data, we connect customers with the prospects, suppliers, clients and partners that matter most, and have since 1841. Nearly ninety percent of the Fortune 500, and companies of every size around the world, rely on our data, insights and analytics. For more about Dun & Bradstreet, visit DNB.com.

D&B Trade Data is acquired from over 12,000 trade exchange participants globally in 35 markets, of which approximately 4,200 are located in the US. Participation is free, confidential and voluntary.

Participants provide their accounts receivable data to D&B on a monthly or quarterly basis which describes how their customers pay their bills by terms of sale, dollar amount of extended credit, amounts owing that are current and past due, and date of last sale. For a trade reference to be to be eligible for the D&B Trade Data (and for use in the PAYDEX calculation), the reported date of the trade experience must be within the last 24-month period and the date of last sale must be within the last 36 months (1-12 months from the reported date).

DocuSign has been set up for you by your Salesforce administrator and will allow you to pre-screen your sales prospects by viewing the D&B PAYDEX and Financial Stress Class Scores.

NOTE: To get access to the Dun & Bradstreet's Pre-Contract Risk Screening, your Salesforce administrator must enable the Verify with D&B button in the Docusign Admin features.

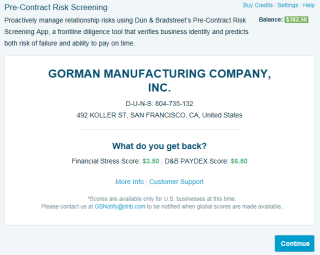

After your account or opportunity is matched to a D&B D-U-N-S Numbered record, you will see what scores are available, as well as, the purchase price of each score.

What is the D-U-N-S Number?

The D-U-N-S Number is a unique nine-digit identification number, developed by D&B in 1962. The D-U-N-S Number is a unique global business identification system that identifies, validates, and relates more than 265+million businesses worldwide.

The D-U-N-S Number at a Glance:

- The D-U-N-S Number is established. The D-U-N-S Number has existed for more than 50 years and is relied on by businesses and government agencies around the world.

- It is global. D-U-N-S Numbers are currently assigned to businesses in more than 190 countries around the world.

- It is proprietary. Only D&B assigns D-U-N-S Numbers which helps ensure accuracy, consistency and integrity. We follow rigorous rules for assignment and maintenance. We assign D-U-N-S Numbers to business locations with a unique, separate and distinct operation. D-U-N-S Numbers are assigned to all types of business organizations including sole proprietorships, corporations, partnerships, and government entities.

- It is lasting. The D-U-N-S Number stays with a business throughout the duration of its life cycle, even bankruptcy.

- It is non-indicative. The nine digits in a D-U-N-S Number are not indicative of any aspect of the company to which it is assigned. It is intensively maintained.

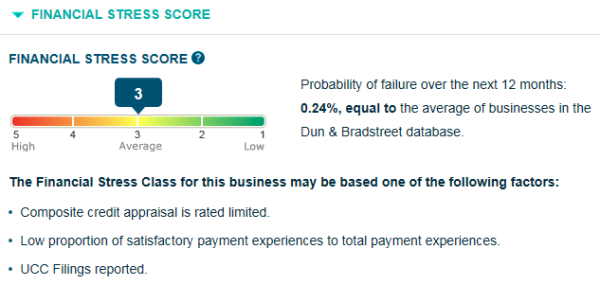

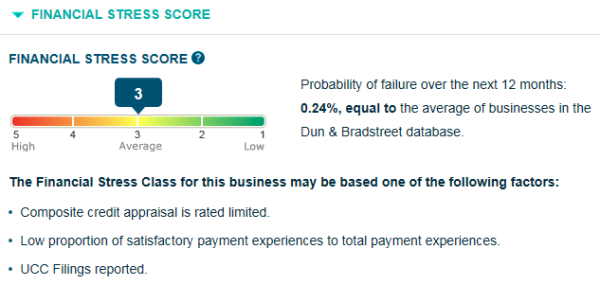

What is the Financial Stress Class Score?

The Financial Stress Score Class Score is a one digit number from 1 to 5 assigned to the business based on information in D&B's file. The higher the class score the greater the likelihood that the organization will seek legal relief from creditors or cease operations without paying all of its creditors in full in the next 12 months.

NOTE: Risk scores are available for U.S. businesses only at this time.

The scores and underlying models are based upon the observed characteristics of hundreds of thousands of businesses in D&B's database and the relationship these characteristics have to the probability of a business experiencing financial stress over a period of 12 months.

NOTE: Voluntary discontinuance involving no loss to creditors is not defined as financially stressed.

The Financial Stress Score assigns a “Risk Class” of 1 – 5, which is a segmentation of the scorable universe into five distinct risk groups where a one (1) represents businesses that have the lowest probability of financial stress, and a five (5) represents businesses with the highest probability of financial stress. This Risk Class enables a customer to quickly segment their new and existing accounts into various risk groups for high-level analysis and reporting.

A Financial Stress Class Score is available on approximately 27 million U.S.-based businesses.

The Financial Stress Class Score will not be available for:

- Business records that are missing an address or have an invalid address.

- Businesses that have been self-reported to D&B without an investigation. Such cases are added to the D&B database as DUNS Support records and will remain as such until a thorough investigation yields more substantial information.

- Businesses designated as “Business Deterioration”1 within one year. These companies continue to operate and have not filed for bankruptcy.

- Businesses in industries that do not lend themselves to scoring through this type of model – specifically, SIC Code 43 (United States Postal Service) and SIC Codes 90-97 (Public Administration, Government Offices).

What is a PAYDEX Score?

The D&B PAYDEX ™ is a number that assesses the payment performance of a business. Based on 24 months of trade experiences reported to D&B by various vendors, it is derived from a weighted average of a company’s combined individual payment experiences and ranges from 0 to 100 with higher scores representing businesses which pay their bills more promptly.

A PAYDEX of 80 denotes that payments reported to D&B have generally been made within terms. A PAYDEX over 80 indicates that payments reported to D&B have been made earlier than terms.

NOTE: Risk scores are available for U.S. businesses only at this time.

The chart below outlines the specific 1-100 PAYDEX and what it means.

| PAYDEX | Indicates the following payment practices |

|---|---|

| 100 | Anticipates |

| 90 | Discounts |

| 80 | Prompt |

| 70 | 15 days beyond terms |

| 60 | 22 days beyond terms |

| 50 | 30 days beyond terms |

| 40 | 60 days beyond terms |

| 30 | 90 days beyond terms |

| 20 | 120 days beyond terms |

| 0 – 19 | Over 120 days beyond terms |

| UN | Unavailable |

Retrieve Scores With a D-U-N-S Number

If your account or opportunity is already linked with a D&B D-U-N-S Number in your Salesforce system, you'll be able to retrieve scores without entering any additional data.

- Locate your opportunity or account in SalesForce.

- At the top of the Opportunity or Account Detail section, click the Verify with D&B button.

- On the Pre-Contract Risk Screening window, click Continue.

- A Confirmation Screen with cost information displays, allowing you to Accept or Cancel. Click Accept to confirm the purchase of the report.

- If you have available credits, the cost will be deducted from your credits. Skip Steps 3 and 4.

- If you have available trial credits, one trial credit will be used for the purchase. Skip Steps 3 and 4.

- If you need to purchase credits to complete the transaction, you will be prompted to purchase more credits.

NOTE: The balance of your available credits is displayed on the top right portion of the D&B Business Solutions window. If you do not have enough purchased credits to complete a transaction, you will be prompted to purchase additional credits.

- On the Purchase Credit page, click on one of the pre-set amounts or enter an amount in the Other field. A pre-set amount is green if it's been selected.

- Click Buy Now and complete the account and order information. Then click Place Order.

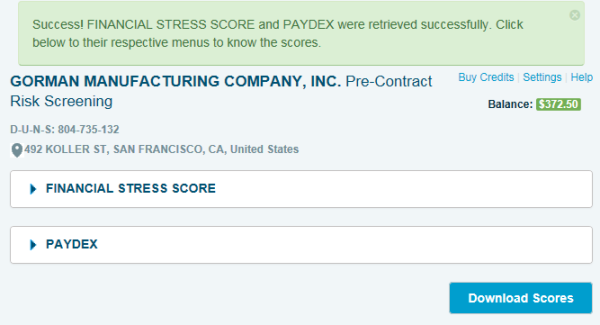

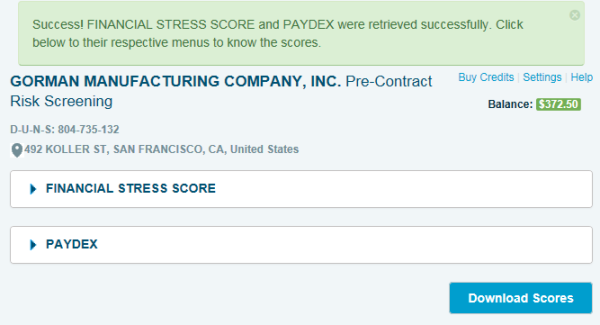

- Your data has been retrieved. You can now view the Financial Stress Class and Paydex scores online and then download the scores in .pdf format.

- Click on Financial Stress Score to expand and view the score.

- Click on Paydex to expand and view the score. The Paydex returns the 24 month D&B PAYDEX and the Days Beyond Terms for this business and the Industry Median PAYDEX.

- Select Save and open to save the .pdf to your downloads file and opens the .pdf.

- Upload the file in the Notes and Attachments section of your account or opportunity in Salesforce.

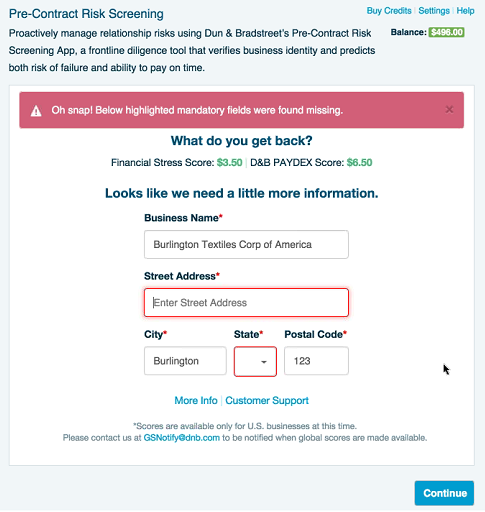

Retrieve Score Without a D-U-N-S Number

If your account or opportunity is already linked with a D&B D-U-N-S Number in your Salesforce system, you'll be able to retrieve scores without entering any additional data.

- Locate your opportunity or account in SalesForce.

- At the top of the Opportunity or Account Detail section, click the Verify with D&B button.

- Complete the missing information on the Pre-Contract Risk Screening window. Required fields are indicated by a red asterisk (*).

- On the Pre-Contract Risk Screening window, click Continue.

- A Confirmation Screen with cost information displays, allowing you to Accept or Cancel. Click Accept to confirm the purchase of the report.

- If you have available credits, the cost will be deducted from your credits. Skip Steps 3 and 4.

- If you have available trial credits, one trial credit will be used for the purchase. Skip Steps 3 and 4.

- If you need to purchase credits to complete the transaction, you will be prompted to purchase more credits.

NOTE: The balance of your available credits is displayed on the top right portion of the D&B Business Solutions window. If you do not have enough purchased credits to complete a transaction, you will be prompted to purchase additional credits.

- On the Purchase Credit page, click on one of the pre-set amounts or enter an amount in the Other field. A pre-set amount is green if it's been selected.

- Click Buy Now and complete the account and order information. Then click Place Order.

- Your data has been retrieved. You can now view the Financial Stress Class and Paydex scores online and then download the scores in .pdf format.

- Click on Financial Stress Score to expand and view the score.

- Click on Paydex to expand and view the score. The Paydex returns the 24 month D&B PAYDEX and the Days Beyond Terms for this business and the Industry Median PAYDEX.

- Select Save and open to save the .pdf to your downloads file and opens the .pdf.

- Upload the file in the Notes and Attachments section of your account or opportunity in Salesforce.

Try the Pre-Contract Risk Screening Solution

Two free trial uses are available per user. Each transaction consumes one trial credit. You will see the same Pre-Contract Risk Screening results using your trial credits as if you were using purchased credits. You will also still be able to download the PDF of the scores. If you have trial credits available, the balance available is displayed in the upper right corner of the Pre-Contract Risk Screening window.

- To Try the Pre-Contract Risk Screening solution, you follow the same steps as if you were buying the solution. If your trial credits have not already been used, you will see two button options--Try and Buy.

- Click Try. You can always click Buy even if you are still in trial mode. Once you have consumed all of your trial credits, you will no longer see the Try button and you will have to purchase credits and/or use the purchased credits.

- You must confirm that you would like to use your trial credit for the transaction.

- Click Accept.