Small Business Risk Insight Chapter

Small Business Risk Insight (SBRI) is a small business risk decisioning solution that consolidates data from participating financial institutions on small business lending performance across the banking, credit card, and leasing industries. This data provides account level and highly predictive lending performance data about existing and prospective business customers. SBRI data combined with D&B’s trade data and D&B’s DUNSRight Quality Process, creates decision-ready insight that can be used across the customer life cycle for targeting, underwriting, and portfolio management/marketing.

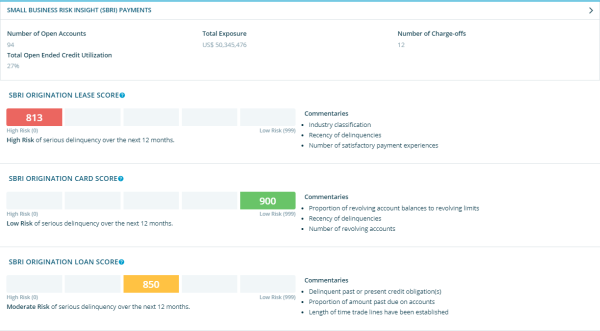

SBRI Origination Scores

The SBRI Origination Scores are a set of three scores designed to predict future business delinquency on loans, credit cards, and leases. These scores can help financial services institutions improve their loan, lease, and business credit card origination strategies and performance to gain a competitive edge in their lending processes.

| Score | Description |

| SBRI Origination Lease Score | A 3 digit numeric score that predicts serious delinquency (4+ cycles) over the next 18 months on a new business lease account. Values are 620 - 999, High Risk to Low Risk. A value of 0 identifies the business as High Risk. |

| SBRI Origination Card Score | A 3 digit numeric score that predicts serious delinquency (4+ cycles) over the next 18 months on a new business card account. Values are 620 - 999, High Risk to Low Risk. A value of 0 identifies the business as High Risk. |

| SBRI Origination Loan Score | A 3 digit numeric score that predicts serious delinquency (4+ cycles) over the next 18 months on a new business loan account. Values are 620 - 999, High Risk to Low Risk. A value of 0 identifies the business as High Risk. |

The SBRI Origination Scores offer the following:

- An unprecedented predictive measure of delinquency on small business credit applicants

- More precise decisioning across the customer life cycle including origination and account management

- Greater visibility into how your customers represent themselves and are leveraged with other lenders so you can have a true picture of their total risk and opportunity

- Easier and faster assessment of the payment performance of your applicants and customers across multiple lenders and financial types

- Deeper insight into how your customers are likely to pay in the coming months so you can proactively manage your offers, collections, and cash flow

SBRI Origination Scores are built using SBRI data so the scores are only available to customers who contribute to SBRI or D&B’s Trade Exchange Program. The scores are available for all businesses registered with a D-U-N-S Number that have archived information or supporting input data.

SBRI Payment Summary Panel

The SBRI Payment Summary Panel provides an overall picture on the lending performance of the company and their total risk exposure.

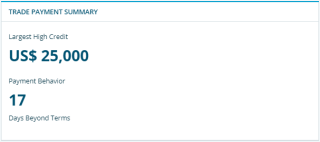

Trade Payment Summary Panel

The Trade Payment Summary Panel provides insight on the company’s payment behavior. This information is also available to the user in detail in the Trade Payments tab.

Account Summaries Panel

The Account Summaries Panel lists the specific lending accounts from SBRI on the company. This list can be filtered by Type/ Date and can be sorted within each column using the arrow. Click on a Type within the first column to open the SBRI Account Details which display more detailed information on the lending account. The Totals row displays the total values based on the filter selection criteria.