Trade Payments Chapter

Trade Payments indicate how quickly a company is likely to pay its bills in the future by reviewing its payment performance with other vendors based on aging, amount of trade, and dollar amounts. Trade Payments utilizes millions of payment experiences from more than 5,000 companies annually. The Trade Payment Summary offers an overview of trade experiences, displayed by key trade elements that demonstrate the credit capacity and payment behavior of the company. Trade Payments by Credit Extended and Trade Payments by Industry give two segmented views that display payment patterns. Trade Lines lists the most recent 80 trade experiences.

Trade Payments Summary Panel

The Trade Payments Summary panel highlights key data elements that display a company’s payment habits and current status.

Average Days Beyond Terms A numerical score assessing how timely the subject has been in paying their bills. It is used as a predictor of future payment habits. |

Highest Now Owing A monetary figure specifying the highest amount owed amongst all the subject's trading accounts. |

Percent of Trade Within Terms A weighted algorithm that assesses a business' historical payment habits for on time payments versus slow payments. Severely slow payments have a larger negative affect on the derivation than do minimally slow payments. |

Total Trade Experiences The number of trading relationships between the subject and its suppliers as reported to D&B within the last 24 months for US/CA/BENELUX and the last 12 months for UK/IRE. |

Largest High Credit A monetary figure specifying the largest of the highest amounts extended to the subject on credit by its suppliers over a specific time period. |

Average High Credit A monetary figure specifying on average what is the maximum amount extended to a subject. |

Highest Past Due A monetary figure specifying the highest amount owed that is beyond terms from amongst all the subject's trading accounts. |

Total Unfavorable Comments (Counts & High Credit) Trade experiences that have any of the following payment comments are included here: placed for collection, bad debt, suit filed, credit refused, unsatisfactory, insufficient funds, and repossession. |

Total Placed in Collections (Counts & High Credit) Trade experiences that are placed for collection, are included here. |

Trade By Credit Extended Displays the percentage that this business paid within terms as a factor of the amount of credit extended. Also, displayed are number of trade experiences used to calculate the percentage and the total credit value of the credit extended from the trading relationships. |

Trade By Industry An overview of the company's currency-weighted payments, segmented by its supplier's primary industries at both the two and four digit SIC Code levels. Applicable to reports for US & CA. |

Trade Payments by Credit Extended Panel

The Trade Payments by Credit Extended panel segments trade experiences by the amount of total credit that has been granted to the company to show how this business has handled obligations of different amounts.

Trade Payments by Industry Panel

The Trade Payments by Industry panel segments trade experiences by two- and four-digit industry classifications to help evaluate how quickly you can expect to be paid, based on a company's payment history with your industry peers. The four-digit industry classifications provide payment behavior details by highlighting the percentage of payments that are within selling terms.

NOTE: % Within Terms only displays for four-digit SIC Code Industry Categories level.

IMPORTANT: This panel is only available for US and CA markets.

The panel displays a list of all the industry classifications that the company does business with, as well as, a list of top five industry groups by the total amount of credit associated with that company are also displayed. The overview shows how a firm pays suppliers and where the highest number of credit transactions is recorded to help you evaluate how quickly you can expect to be paid. This is based on a company's payment history with your industry peers.

Trade Lines Panel

The Trade Lines panel lists the most recent payments experiences (up to 80), each from a separate supplier, that reflect how bills are paid in relation to the selling terms granted. An unusually large number of transactions during a single month or time period may indicate a seasonal purchasing pattern.

IMPORTANT: This panel is only available for US and CA markets.

The following Payment Status levels appear most frequently:

Pays Early Payments are received prior to date of invoice. |

Discounted Pay Payments are received within a trade discount period. |

Pays Promptly Payments are received within selling terms granted (Prompt). |

Pays Slow or Slow # Payments are beyond selling terms. For example, Slow 30 means payments are 30 days past due. |

Pays Prompt to Slow Some invoices are paid within selling terms, while others are paid beyond selling terms. |

| – A dash indicates that no Payment Status was provided; reference Selling Terms for more detail. |

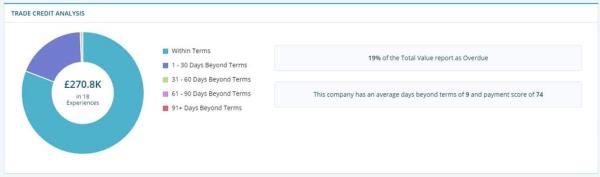

Trade Credit Analysis

The Trade Credit Analysis panel segments a company's payment history based on aging. It represents each segment as a percentage of the overall value of trade experiences. The commentary to the right of the chart provides insight into the percentage of Trade Overdue and how a company is paying their bills, on average.

IMPORTANT: This panel is only available for UK, IRE, and BENELUX markets.