Managing a Decision Outcome

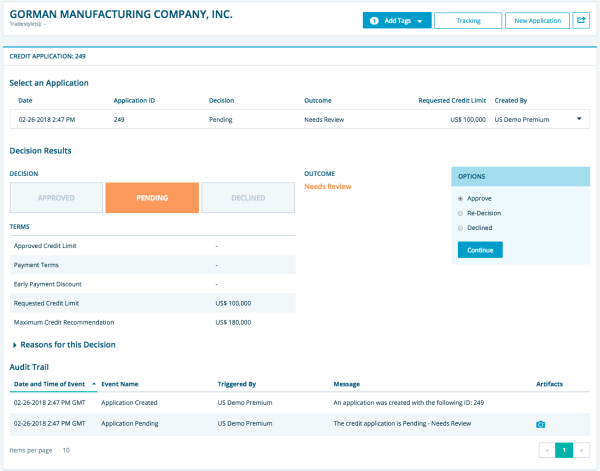

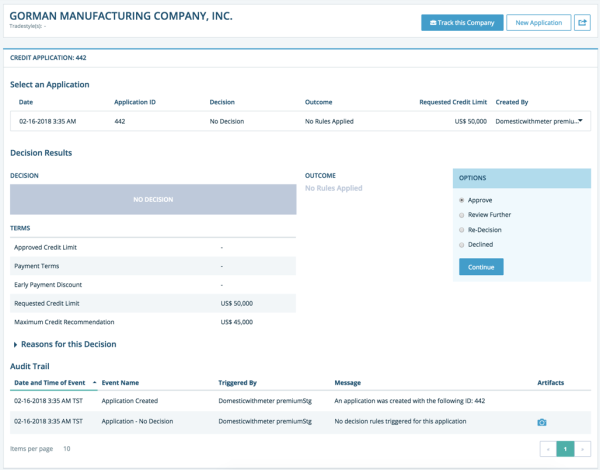

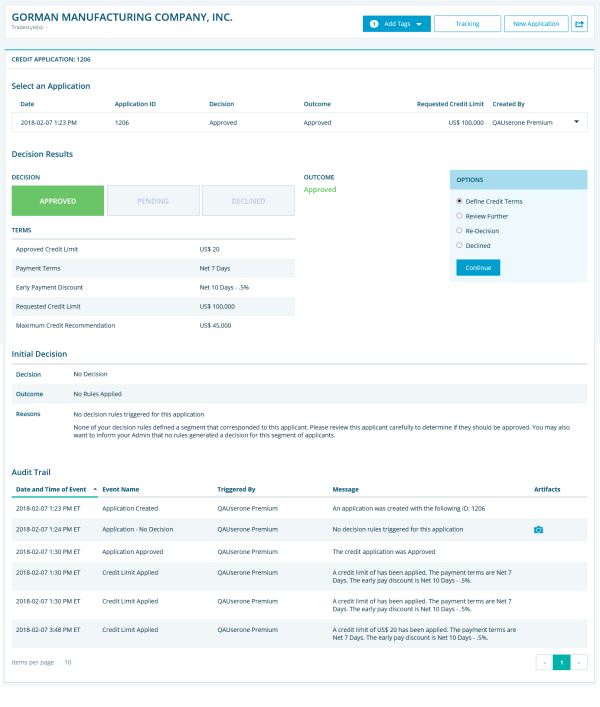

The Credit Applications chapter within the Credit Report displays the submitted credit applications for a company. D&B Credit Premium users can select an application to view its decision outcome. The credit decision results also include the conditions that were met to satisfy the outcome, any comments added by the Administrator, and an audit trail of each event that occurred for the application.

User Options for Credit Decision Results

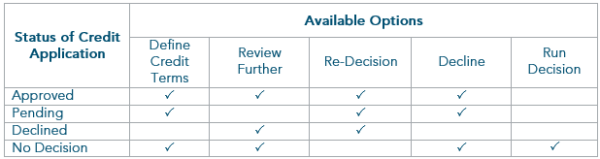

After reviewing the credit results, users can make changes to the credit decisions within the Credit Application results. Depending on the status of the application, Approved, Pending, or Declined, different options are available. All changes or additions made to credit results are recorded within the application's audit trail.

NOTE: The application status will display as No Decision if none of the decision rules can be applied to the application. This occurs due to one of the following reasons:

- No rules have been created.

- No rules have been turned on (enabled) where the applicant can satisfy the segment for the decision rule. If this occurs, contact your Administrator to create new rules or adjust existing rules.

Administrators create the automated credit decision work flow. Once an application is submitted, the user will see the following on the Credit Application page:

- A high-level decision (Approved, Pending, or Declined)

- The detailed outcome (Approved 1, Approved 2, Approved 3, Needs Review, Manager Escalation, Supervisor Escalation, or Declined)

Users can manually approve, decline, or override decision results. The following describes the available options to modify the decision. This list of options is based on the current outcome status.

From the Credit Applications page, use the radio buttons on the right of the Decision Results to make a selection.

- Define Credit Terms prompts you to enter a Currency, Approved Credit Limit, Payment Terms, and Early Payment Discount.

- Review Further updates the application's status to Pending. You can select Review Further, Manager Escalation, or Supervisor Escalation.

- Re-Decision prompts you to re-apply a decision rule to an application using either the Original D&B data or the Most Recent D&B data. Most recent D&B data applies to changes within live reports.

- Decline allows you to override the original decision and decline the application.

- Run Decision allows you to submit the application again if the original submission resulted in a No Decision.

The following table lists the available user options for each of the automated credit application outputs.

NOTE: If a new decision is generated, via manual override or re-decision, the new decision will be placed at the top and the initial decision will be summarized below.

Audit Trail

The Audit Trail shows every change that was applied to the application; for example, the name of the user who overrode a certain rule or decision. Audits for an application can be sorted by date and time of event. To view a snapshot of the credit report with decision detail, click the![]() icon.

icon.

Review a Credit Application (previously submitted)

To review credit applications from one D-U-N-S Number, go to the Credit Application chapter.

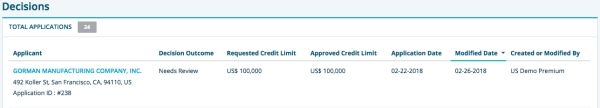

To review the list of all submitted credit applications, go to the Decisions section at the top of the page.

The Decisions section lists all credit applications with outcomes and supporting information. Here you can select a specific application to review or manage.

Sort the list by Decision Outcome; e.g., Needs Review, to identify the needed application. You can also get more details by clicking on the Applicant Name.