Risk Assessment Chapter

Dun & Bradstreet (D&B) evaluates the sustainability and payment behavior of a company by assessing the risk of failure and the risk of slow-to-severely-delinquent payments through scores, ratings, and indices. The assessment is designed to help you decide if you should conduct business with a company and to help you define credit terms.

The Risk Assessment Chapter includes both a D&B Risk Assessment of the company and individual panels of key statistics and graphs for conducting risk assessments. The D&B Risk Assessment includes an overall risk level with commentary based on the report information and a Maximum Credit Recommendation. The individual panels include the D&B Viability Rating, Failure Score, Delinquency Score, PAYDEX® and D&B Rating. Supplemental details in the individual panels include the risk level, probability of an event occurring, and trending and comparative statistics to normalize your view of risk. The six are assigned based on the probability of an event occurring, ranging from Low to Severe risk, and ultimately reflecting an Out of Business status.

When the company is Out of Business or other special events occur, many of the sections within the panels will be suppressed as a score and the rating or index cannot be calculated.

What does Dun & Bradstreet think?

Dun & Bradstreet offers a perspective on the company with a D&B Risk Assessment and Maximum Credit Recommendation.

D&B Risk Assessment Panel

Dun & Bradstreet delivers an Overall Risk Assessment that uses the best available scores, ratings, and indices to provide an Overall Business Risk and what Dun & Bradstreet Thinks.

Overall Business Risk

The overarching Low to High Risk Levels are based on the combination of individual risk levels for scores, ratings, and indices that have been assessed for the specific company.

The Severe Risk Level is based on events that should be given more careful attention, i.e., Significant Business Distress, Bankruptcy, or Other Serious Legal Events. A description of the event will be placed under the Risk Level.

Undetermined Risk is assigned when there is a lack of information to accurately assess the company.

Dun & Bradstreet Thinks...

To accompany the Risk Level, there are supportive commentary bullets that interpret the individual risk levels:

- Holistically across all scores, ratings, and indices that give a perspective on business discontinuation/failure

- Failure Score

- Portfolio Comparison from the Viability Rating

- Risk Indicator from the D&B Rating

- Holistically across all scores, ratings, and indices that give a perspective on payment behavior

- Delinquency Score

- PAYDEX

- Triple-A Rating

- 1-2 Trade Experiences

- Financial Strength from the D&B Rating

Reference individual scores to better understand the probability of failure or severe delinquency of a company.

Maximum Credit Recommendation

Maximum Credit Recommendation is the greatest amount of credit D&B suggests that an average unsecured creditor should extend to the organization, based on monthly payment terms. It can cover multiple accounts and multiple invoices for a total outstanding figure. However, the recommended amount is not necessarily the maximum amount the organization could afford.

Alongside what Dun & Bradstreet Thinks about the organization’s risk, a Maximum Credit Recommendation is offered based on key risk indicators found in the report such as:

- The credit demand within the industry

- The size of the organization (financial and human capital)

- The organization’s risk of failure or delinquency

Some markets do not have a Maximum Credit Recommendation but do recommend alternative limits:

- Transactional Credit Limit is the greatest amount of credit that an average unsecured creditor should extend in one transaction to the organization, based on monthly payment terms. The Transactional Credit Limit covers a single invoice. The following markets recommend this limit: Czech Republic, France, Germany, Poland and Slovakia.

- Total Credit Recommendation is the total amount of credit that an average unsecured creditor should extend to the organization for one year. The Total Credit Recommendation can cover multiple accounts and multiple invoices for a total credit relationship of 12 months. The following markets recommend this limit: Austria, Czech Republic, Germany, Poland and Slovakia.

What Do You Think?

Evaluate the company for yourself with the individual scores, ratings, and indices.

D&B Viability Rating Panel

The D&B Viability Rating predicts the likelihood that a company will go out of business, become inactive, or file for insolvency over the next 12 months. This risk indicator assesses the viability of a company compared to businesses with a similar risk profile.

NOTE: Mid to large size businesses are more likely to formally file for bankruptcy, while mid to small businesses are more likely to become dormant/inactive.

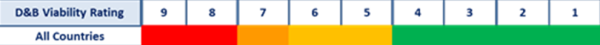

Viability rankings range from 1-9, where 9 represents the highest risk of going out of business or becoming inactive and 1 represents the lowest risk.

Supplemental D&B Viability Rating components include:

Level of Risk

Assigns the risk of a company becoming no longer viable which ranges from low to severe and provides an at-a-glance risk assessment.

Rating Confidence Level

Identifies of how much weight you should place on the Viability Rating based on data depth. The more information Dun & Bradstreet has on a company, the stronger the confidence you can place in the rating. From least to greatest, the Rating Confidence Levels are Basic, Directional, Decision Support, and Robust Predictions.

Data Depth

Presents the level of data that is available for a company that includes Financial Attributes, Commercial Trading Activity, Firmographics, and Other Business Activities. Data Depth is used to generate the D&B Viability Rating and define the Rating Confidence Level.

Probability of Becoming No Longer Viable

States the likelihood of the specific company becoming no longer viable, compared to companies with a similar risk profile.

Percentages of a Business Ranked with the Same Score

Highlights the proportion of companies with a similar risk profile that have the same D&B Viability Rating as the company.

Average Probability of Becoming No Longer Viable

States the likelihood of a company, with a similar risk profile, becoming no longer viable.

Failure Score Panel

The Failure Score (previously known as FSS) predicts the likelihood that a company will obtain legal relief from its creditors or cease operations over the next 12 month period. Several events can signal the onset of failure, such as, a meeting of creditors, appointing an administrator, filing for bankruptcy, appointing a receiver, or petitioning for winding-up.

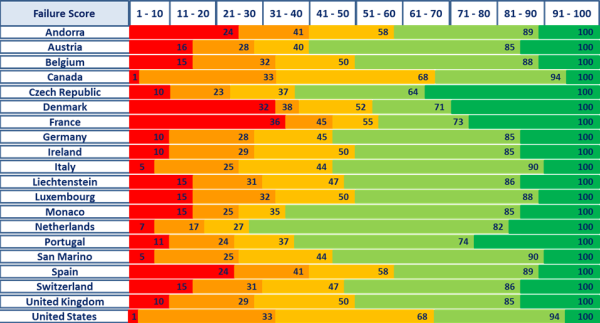

Failure Scores range from 1-100, where 1 represents the highest risk of failure and 100 represents the lowest risk and can assist in creating a rank order of your portfolio from highest to lowest risk of business failure.

Supplemental Failure Score components include:

Level of Risk

Assigns the risk of a company becoming no longer viable which ranges from low to severe and provides an at-a-glance risk assessment.

Raw Score

The raw score has the same underlying data as the score, however, it is a more specific classification of risk and is helpful when you want to see precisely where a business falls on the spectrum of risk. The Raw Score ranges from 1,001 – 1,875, where a 1,001 represents businesses that have the highest probability of financial stress, and a 1,875 which represents businesses with the lowest probability of financial stress. The Raw Score provides more granular cutoffs that can be helpful in automated decision-making since it is consistent across markets.

Failure Reasons

Lists key events that factored into the company’s evaluation and Failure Score.

Probability of Failure

States the likelihood of the specific company experiencing business failure.

Average probability of Failure for Businesses in the D&B Database

States the likelihood of a company experiencing business failure, based on all companies within the D&B database.

Business and Industry Trends

Presents a 12-month Failure Score trend of the specific company and an average of the primary industry for the company. Dates include the current score and 11 months prior.

Delinquency Score Panel

The Delinquency Score (previously known as CCS or Delinquency Predictor) predicts the likelihood that a company will pay in a severely delinquent manner over the next 12 months. A severely delinquent company is primarily defined as a business with at least 10% of its dollars 90+ days beyond payment terms.

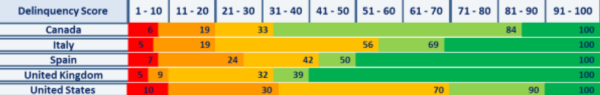

Delinquency Scores range from 1-100, where 1 represents the highest risk of delinquency and 100 represents the lowest risk and can assist in creating a rank order of your portfolio from highest to lowest risk of severe delinquency.

Supplemental Delinquency Score components include:

Level of Risk

Assigns the risk of a company becoming no longer viable which ranges from low to severe and provides an at-a-glance risk assessment.

Raw Score

The raw score has the same underlying data as the score, however, it is a more specific classification of risk and is helpful when you want to see precisely where a business falls on the spectrum of risk. Delinquency Scores range from 101 - 670, where a 101 represents businesses that have the highest probability of severe delinquency, and a 670 represents businesses with the lowest probability of severe delinquency. The Raw Score provides more granular cutoffs that can be helpful in automated decision making since it is consistent across markets.

Delinquency Reasons

Lists key events that factored into the company’s evaluation and Delinquency Score.

Probability of Failure

States the likelihood of the specific company experiencing business failure.

Average probability of Failure for Businesses in the D&B Database

States the likelihood of a company experiencing business failure, based on all companies within the D&B database.

Business and Industry Trends

Presents a 12-month Delinquency Score trend of the specific company and an average of the primary industry for the company. Dates include the current score and 11 months prior.

PAYDEX® Panel

PAYDEX ® summarizes the payment performance of a company in the past 12-24 months. Based on a number of months (dependent of Country/Region) of trade experiences reported to D&B by various vendors, it is derived from a weighted average of a company’s combined individual payment experiences.

The PAYDEX® ranges from 0-100 where 0 represents the most severe delinquency. An index of 80 reflects prompt payment and any index greater than 80 reflects payment before the agreed upon terms, potentially benefitting from discounts.

Supplemental PAYDEX ® components include:

Risk of Slow Pay

Assigns the risk of slow payment ranging from low to severe.

Payment Behavior

Displays the payment performance in relation to supplier terms, reflecting whether payments have been made before terms, promptly at terms, or beyond terms.

Business and Industry Trends

Presents a 12-month PAYDEX ® trend of the specific company and the upper 25%, median and lower 25%. Dates include the current PAYDEX ® and 11 months prior.

D&B Rating Panel

D&B Rating is a proprietary indicator that quickly assesses the creditworthiness of a company based on the financial strength of the business, payment behavior, age of the company, company size, and other important factors. As the D&B Rating changes, both the Current and Previous rating will be displayed.

The rating includes one or more of the following components:

Financial Strength

Indicates credit capacity and is based on net worth or equity as computed by D&B from financial statements supplied by the company.

The blank rating symbol should not be interpreted as indicating that credit should be denied. It simply means that the information available to D&B does not permit us to classify the company within our rating key and that further inquiry should be made before reaching a decision. Some reasons for using a "-" symbol include: deficit net worth, bankruptcy proceedings, insufficient payment information, or incomplete history information.

Risk Indicator

Highlights the chance of business failure, ranging from 1 – 4, with one reflecting low/minimum risk and four reflecting high risk.

Employee Size

Represents the company size as a credit evaluation tool in the absence of financial statements.

Special Rating

Applies to companies where a Financial Strength or Employee Size is either irrelevant or cannot be determined, e.g., NQ for Out of Business or NB for New Business.