Country Risk Indicator

D&B’s Country Risk Indicator is referenced in the Compliance section of the Compliance Report which includes Know Your Customer (KYC) information. It provides a comparative, cross-border assessment of the risk of doing business in a country. Essentially, the indicator seeks to encapsulate the risk that countrywide factors pose to the predictability of export payments and investment returns over a time horizon of two years. The risk indicator comprises a composite index of four over-arching country risk categories described in the following table:

| Country Risk Categories |

|---|

Political Risk Internal and external security situation, policy competency and consistency, and other such factors that determine whether a country fosters an enabling business environment. |

Commercial Risk The sanctity of contract, judicial competence, regulatory transparency, degree of systemic corruption, and other such factors that determine whether the business environment facilitates the conduct of commercial transactions. |

Macroeconomic Risk The inflation rate, government balance, money supply growth and all such macroeconomic factors that determine whether a country is able to deliver sustainable economic growth and a commensurate expansion in business opportunities. |

External Risk The current account balance, capital flows, foreign exchange reserves, size of external debt and all such factors that determine whether a country can generate enough foreign exchange to meet its trade and foreign investment liabilities. |

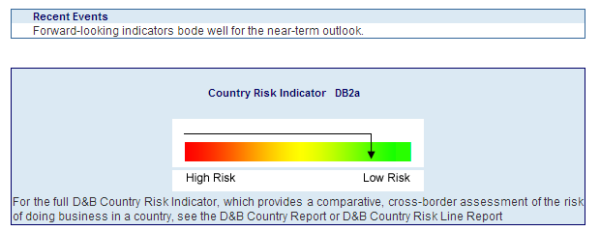

The DB risk indicator is divided into seven bands, ranging from DB1 through DB7. Each band is subdivided into quartiles (a–d), with an "a" designation representing slightly less risk than a "b" designation, and so on. Only the DB7 indicator is not divided into quartiles.

| Indicator Meaning Explanation |

|---|

DB1: - Lowest risk Lowest degree of uncertainty associated with expected returns, such as export payments, and foreign debt and equity servicing. |

DB2: - Low risk Low degree of uncertainty associated with expected returns. However, country-wide factors may result in higher volatility of returns at a future date. |

DB3: - Slight risk Enough uncertainty over expected returns to warrant close monitoring of country risk. Customers should actively manage their risk exposures. |

DB4: - Moderate risk Significant uncertainty over expected returns. Risk-averse customers are advised to protect against potential losses. |

DB5: - High risk Considerable uncertainty associated with expected returns. Businesses are advised to limit their exposure and/or select high-return transactions only. |

DB6: - Very high risk Expected returns subject to large degree of volatility. A very high expected return is required to compensate for the additional risk or the cost of hedging such risk. |

DB7: - Highest risk Returns are almost impossible to predict with any accuracy. Business infrastructure has, in effect, broken down. |

The DB risk indicator is supplemented with a ratings trend, which encapsulates whether the risk environment in a country is improving, deteriorating or stable:

| Ratings Trend |

|---|

Improving Indicates that the country’s overall risk profile is improving as a result of |

Deteriorating Indicates that the country’s overall risk profile is deteriorating owing to adverse political, commercial, economic and/or external developments. |

Stable Indicates that the country’s overall risk outlook has not changed appreciably, even though some minor changes to its political, commercial, macroeconomic, and/or external risk environment may have occurred. |