Credit Limits

While Dun & Bradstreet may suggest a maximum credit recommendation, workspace Administrators may define logic to calculate their own custom Credit Limits to be added to the credit report

NOTE: The Credit Limits section is accessible to D&B Credit Advantage and Premium Administrators only.

Within the Credit Limits section, multiple decision rules can be created.

Creating a New Credit Limit

To access the Credit Limit Customization screen:

- Click Tools.

- Click Credit Limits under Guidance in the left-hand menu.

- Click Create New Credit Limit.

To create a new credit limit:

Each required step must be completed to enable a customized credit limit. Click Next after each step to navigate to the subsequent screens or click the tab of the desired step.

A name is required to save the credit limit logic since there may be more than one type of credit limit.

Type a name for the credit limit in the prompt.

The currency used to evaluate all companies is one of the requirements for customizing a credit limit.

- Select a currency from the drop-down list. The local currency will always be the default selection.

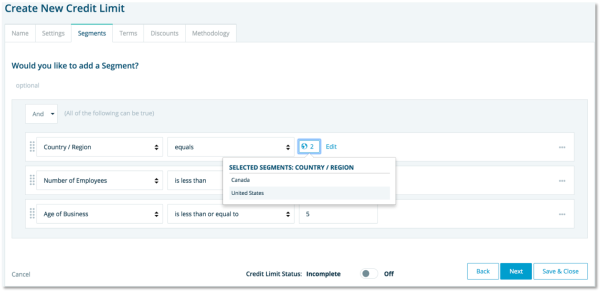

A credit limit can be applied to a specific segment of companies based on a set number of variables.

If applicable, specify the types of companies that will have the credit limit calculated based on the defined logic. Hover over the number of countries/regions or lines of business to see the detailed list.

Each credit limit requires defined credit terms, even if the terms are set to None.

Select a credit term from the drop-down menu.

Each credit limit also requires any defined discounts that can be applied based on early payment.

Select the discount that can be applied to the credit limit based on the number of days the invoice was paid in advance.

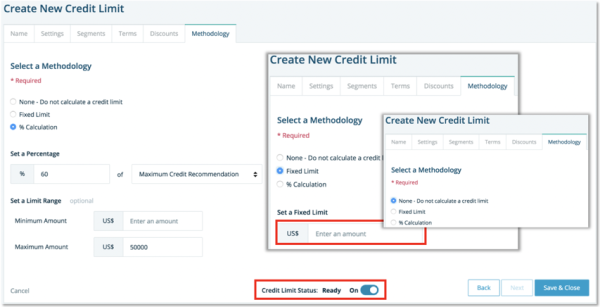

The logic behind the credit limit calculation must now be defined. There are three available options:

- Not calculating a credit limit.

- Defining a fixed amount for the credit limit.

- Taking a percentage of an amount.

NOTE: The most frequently used elements are the D&B Maximum Credit Recommendation, Average High Credit, Largest High Credit, or Sales.

To take a percentage of an amount:

- Enter the percentage.

- Select the data element that will be used in the calculation.

- If applicable, set a minimum and/or maximum amount for the credit limit.

Once all requirements are entered, the credit limit must be enabled.

To enable a credit limit:

- Click On at the bottom of any screen.

- Click Save and Close.

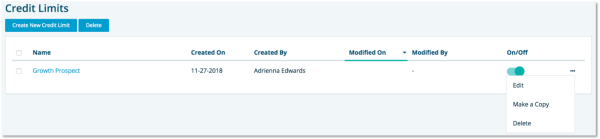

Credit limit logic can also be turned on or off from the List page. The current order of the credit limits on the list page will be the order displayed in the company’s credit report.

Credit limits are considered incomplete and will not be calculated if any of the following required sections are incomplete:

- Credit limit logic has not been named.

- Currency has not been selected.

- Credit terms and discounts have not been defined.

- Methodology has not been created.

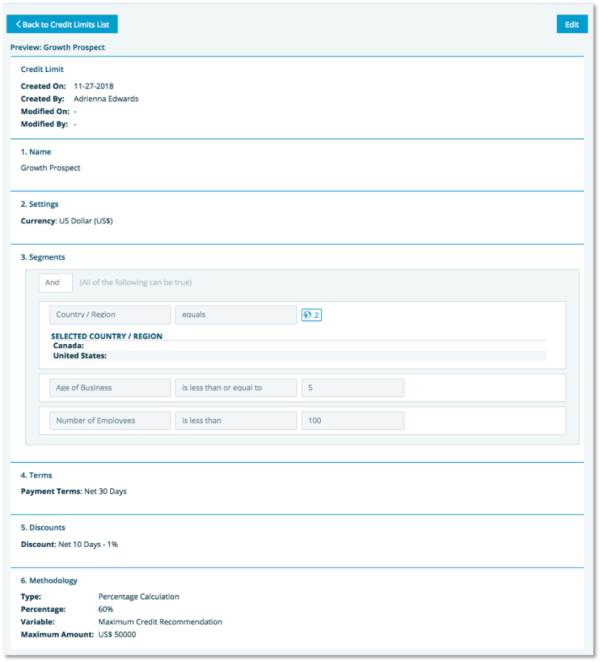

Clicking the name of the Credit Limit takes you to a preview of the logic.

Editing a Credit Limit

Administrators may copy, edit, or delete an existing credit limit logic. The copied rule will be placed at the top of the list and given the same name prefixed by, Copy of.

To edit an existing credit limit:

- Click the ellipses (three dots) to the right of the list view page for the desired credit limit logic and select Edit.

- Select the desired tab or click Next to navigate to the desired section.

- Make any additional desired changes in the chosen tab.

- Click Save and Close.

NOTE: The credit limit logic remains enabled when all the required sections are completed before clicking Save and Close. If all required sections are not complete, the credit limit logic is disabled and will have an Incomplete status.

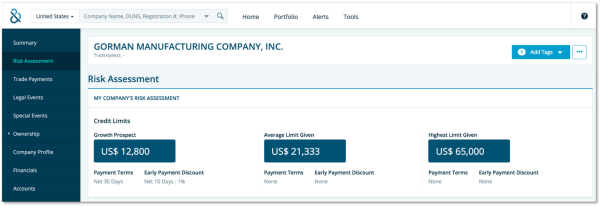

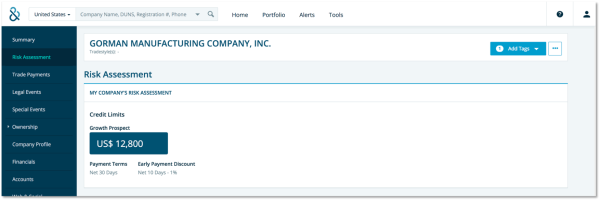

Viewing the Custom Credit Limit

If the credit report has been purchased and the company satisfies the segment defined in the credit limit logic, then the credit limit will be calculated for the company. Both the Summary and Risk Assessment tabs will display the calculated credit limit whenever the company satisfies the segment.

If the company satisfies defined segments from multiple credit limits, then each one will be calculated individually.