Days Sales Outstanding

The Days Sales Outstanding (DSO) tool provides the ability to examine a Sales Weighted DSO number for the entire portfolio or a filtered set of accounts by calculating the average number of days it is taking to collect debt from accounts.

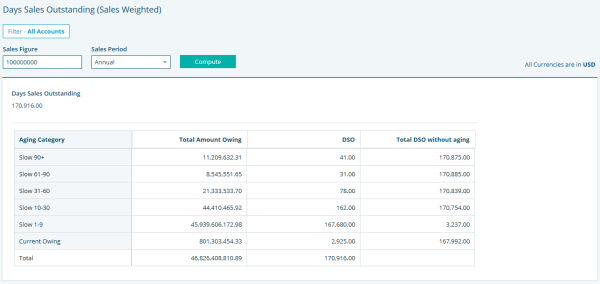

FIGURE 1. Days Sales Outstanding

To access the DSO Tool:

- Click Analysis in the top navigation bar.

- Select Days Sales Outstanding on the left navigation panel.

Creating DSO

To create a DSO:

- Specify the filter (select or all accounts) you wish to do the analysis on.

- Enter the Sales Figure.

- Select a Sales Period.

- Click Compute.

- Select the accounts by selecting a filter or All Accounts for the entire portfolio.

NOTE: Available Sales Periods are: Monthly (30 Days), Quarterly (91 Days), Semi Annual (182 Days) and Annual (365 Days).

NOTE: The Total Amount Owed, DSO, and New Total DSO without Aging will be calculated.

Understanding the data:

- Aging Category - shows each aging bucket that is in the database

- Total Amount Owing - shows the total amount outstanding for each aging category and is totaled at the bottom

- DSO Column - shows the average number of days outstanding for each aging category and is totaled at the bottom

- Total DSO Without Aging - shows the new Total DSO after the Total Amount Owed for the Aging category of that row has been collected

NOTE: DSO is the Total Amount Owing divided by Daily Sales.

For Example:

- Slow 90 + DSO = 30

- Total DSO = 100, Total Owing for Slow 90+ was collected

- Total DSO Without Aging = 70