Risk Assessment

Dun & Bradstreet evaluates the sustainability and payment behavior of a company and assesses the risk of failure or slow payment through scores, rating and indices. The assessment is designed to help you decide whether to conduct business with a company as well as assist in defining credit terms.

Risk Assessment Components

The Risk Assessment has a summary page to highlight key insights within each risk section and a corresponding detailed page for a deeper dive of each risk section. Both the summary and detailed pages include an overall risk assessment of the company conducted by Dun & Bradstreet and a panel for each of the scores, ratings and indices for you to conduct your own risk assessment. The panels include the following the Viability Rating, Failure Score, Delinquency Score, PAYDEX (payment index) and D&B Rating.

Each number within the score, rating or index has a probability of the event occurring. One of the following risk levels will be assigned based on the probability of the event:

The Summary section can be accessed from the left navigation and will automatically be displayed upon viewing a credit report. The detailed Risk Assessment section can be accessed from the left navigation or from the top right Risk Assessment panel within the Summary section. If the company is out of business then many of the sections will be suppressed as a score, rating or index cannot be calculated.

Risk Perspectives

Dun & Bradstreet Thinks...

Dun & Bradstreet offers a perspective on the company first with the D&B Risk Assessment and Maximum Credit Recommendation.

D&B Risk Assessment

Dun & Bradstreet begins with an overall risk assessment of the company by combining the best available scores, ratings and indices into one overarching risk level with supporting commentary based on perceived business sustainability and payment behavior. You can review the D&B Risk Assessment for an overall view of what Dun & Bradstreet thinks about the company from a risk perspective.

Maximum Credit Recommendation

Alongside what Dun & Bradstreet thinks about the company’s risk, a Maximum Credit Recommendation is offered based on key risk indicators found in the report like the organizational size (financial and human capital), industry and risk of failure/delinquency. The recommendation reflects the total value of goods and / or services the “average” creditor should have outstanding at any one time, it is not necessarily the maximum the organization could afford.

What Do You Think?

Evaluate the company for yourself with the individual scores, ratings and indices. The summary section will show the risk level, probability of the event occurring and a sparkline that reflects a 12 month trend. More information can be found by navigating to the detailed section which introduces average probabilities of an event occurring and industry trends to normalize your view of risk. Current country coverage varies by score but more countries will be added over the next months to increase global coverage.

D&B Viability Rating

Review the Viability Rating to understand the probability of business failure in the form of bankruptcy/insolvency but also those that may become dormant or inactive over the next 12 months.

NOTE: Mid to large size businesses are more likely to formally file for bankruptcy while mid to small businesses are more likely to become dormant/inactive.

The detailed section includes the Rating Confidence Level which informs you of how much weight you should place on the Viability Rating. The more information Dun & Bradstreet has on a company, the stronger the confidence you can place in the rating. From least to greatest, the Rating Confidence Levels, are Basic, Directional, Decision Support and Robust Predictions. Mouse over the (i) next to the Rating Confidence Level view the depth of data that was available to calculate the Viability Rating and accompanying the Rating Confidence Level. Currently, there is no trend graph available for the Viability Rating.

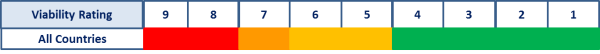

The Viability Rating ranges from 1-9 with the highest number reflecting the highest risk.

Failure Score

Review the Failure Score to understand the probability of business failure in the form of bankruptcy/insolvency over the next 12 months. The detailed section includes a list of reasons for assigning the specific score to the business.

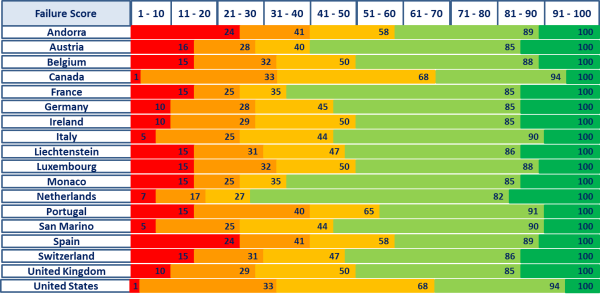

The Failure Score ranges from 1-100 with the lowest number reflecting the highest risk.

Delinquency Score

Review the Delinquency Score to understand the probability of severely delinquency payment over the next 12 months. The detailed section includes a list of reasons for assigning the specific score to the business.

The Delinquency Score ranges from 1-100 with the lowest number reflecting the highest risk.

D&B PAYDEX®

Review the PAYDEX to understand how a company has paid its bills in the past 12-24 months. Payment behaviour ranges from early payments (potentially benefitting from discounts) to slow or even severely delinquent payments. Unlike the Failure and Delinquency Score, the PAYDEX offers a more detailed comparison between the business and industry trends. The industry is broken into the upper 25%, median and lower 25%.

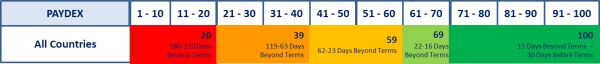

The PAYDEX ranges from 1-100 with the lowest number reflecting severe delinquency. An index of 80 reflects prompt payment and any index greater than 80 reflects payment before the agreed upon terms.

D&B Rating

The D&B Rating is a combination of codes to reflect Financial Strength, Employee Size and a Risk Indicator. The rating helps you to understand the creditworthiness of a business based on the size of the organization, financial strength through tangible net worth and the sustainability of the business. Once the D&B Rating changes, you will be able to review both the current and previous rating as well as the date of the rating change.

The "5A" to "HH" or “H” Rating Classifications reflect the Financial Strength based on net worth or equity as computed by D&B. Financial Strength can be an effective indicator of credit capacity. These Ratings are assigned to businesses that have supplied D&B with a current financial statement.

The "1R" and "2R" Rating categories reflect the Employee Size based on the total number of employees for the business. They are assigned to company files that do not contain a current financial statement.

ER (Employee Range) Ratings apply to certain lines of business that do not lend themselves to classification under the D&B Rating system. Instead, we assign these types of businesses an Employee Size (range) symbol based on the number of people employed. No other significance should be attached to this symbol. "ERN" should not be interpreted negatively. It simply means we do not have information indicating how many people are employed at this firm.

If the D&B Rating is not available then the rating will be display a “-” and a message based on the status of the company instead of the rating description. Similarly, a Special Rating is applied to the business, a message will accompany the rating, e.g. NB for New Business or NQ for Out of Business.

Lastly, the Risk Indicator reflects the sustainability of the business and ranged from 1 – 4 with 1 reflecting low/minimum risk and 4 reflecting high risk.

The terms listed below are used in D&B Credit.

| Risk Assessment Terms |

|---|

D&B Risk Assessment Comprehensive risk evaluation that defines the risk level, payment behavior and sustainability of a business based on trade payments, risk indicators, age and size of business, financials and other key credit information. |

Credit Capacity The highest credit limit D&B suggests should be extended based on a business’ payment behavior, company size and industry. |

D&B Viability Rating Assesses of the probability that a company will go out of business, become dormant/ inactive, or file for bankruptcy/insolvency within the next 12 months by comparing like businesses. The rating ranges from 1 to 9 with higher scores indicating a greater probability of a business no longer becoming viable. |

Failure Score Predicts the likelihood that a business will seek legal relief from its creditors or cease operations leaving unpaid debts in the next 12 months. The score ranges from 1 to 100, with higher scores indicating a lower probability of failure. |

Delinquency Score Predicts the likelihood that a business will pay its bills in a severely delinquent manner (91+ days beyond term) over the next 12 months. The score ranges from 1 to 100, with higher scores indicating a lower probability of delinquency. |

D&B Rating D&B's proprietary indicator that quickly assesses a company's size and composite credit appraisal based on analysis of company payments, financial information, business age and other important factors. |